When your B2B company provides value to its customers and they reward you by remaining loyal and referring others, you increase the value of your business. That’s why you got into business in the first place, right? Now, the hard question – do you know the valuation of your company today and how to increase that valuation year-over-year until you’re ready to exit? Most business owners feel they know the answer to this, but when it’s time to start exiting, they’re unpleasantly surprised.

To give you a thorough and realistic means of estimating and improving your business’s valuation, in this blog, I’ll cover:

- How to value your company using the build-up method to get a cap rate.

- Which areas of the company have a greater impact on the value than you might think.

- How implementing revenue operations (RevOps) strategies today will support the valuation process and ensure you’re ready to exit on your terms.

What is the Best Way to Value Your Company?

When it comes to B2B business valuations there are three accepted methods:

- Market-Based (value using comparables or “comps,” like buying a house)

- Asset-Based (value of the assets, usually used when a business is in distress)

- Discounted Cash Flows or DCF (the value is based on the capitalization rate).

We’re going to focus on number three, the DCF. To estimate discounted future cash flows, first we want to arrive at a cap rate. The cap rate represents the measure of your risk – the higher the cap rate, the lower your valuation, the lower the cap rate, the higher the valuation. To get the cap rate, we use the build-up method.

How to Value Your Company Using the Build-up Method to Get a Cap Rate

The build-up method determines the net cash flow discount rate, which gives you the cap rate. This method uses various sources to get the sum of risks associated with assorted asset classes.

The example below shows the types of information you would use in the build-up method. Sections A., B., and C. are out of the company’s control. Sections D. and E. can be adjusted through efficient management and revenue operations strategies.

Additionally, using the categories in the chart, you can assign a growth rate (percent per year) to estimate future cash flows, followed by calculating the net present value (NPV) of future earnings + terminal value to arrive at a targeted enterprise value.

For example, to make it easy, let's say you have a hypothetical company with "Future" SDE (Seller Discretionary Earnings) or estimated "Future Cash Flows" of $1,000,000.

Using the two “total capitalization rates” in the example, you would have a valuation range between $3.7M (26.96%/$1,000,000) and $5.4M (18.45%/$1,000,000), which is basically (SDE/CapRate). This compares low risk and high risk, with the higher the cap rate being higher risk.

|

A |

Risk-Free Investment Rate |

Low Risk |

High Risk |

|||||

|

20 year long-term Treasury Bond Yield |

4.09% |

4.09% |

||||||

|

10 year long-term Treasury Bond Yield |

||||||||

|

B |

Equity Risk Premium |

|||||||

|

S&P 500 Index |

6.00% |

6.00% |

||||||

|

C |

Size Premium |

(Risk factor for industry) |

||||||

|

Micro Cap, 9-10 sector |

6.36% |

6.36% |

||||||

|

* |

Ibbotson Assoc. 2011 Yearbook Valuation |

|||||||

|

D |

Specific Company Risk Factors |

|||||||

|

1% (low) – 7% (high) |

||||||||

|

1 |

Financial Stability of the Company |

0.00% |

0.50% |

|||||

|

2 |

Management Depth |

1.00% |

1.00% |

|||||

|

3 |

Business Type & Industry |

0.00% |

1.00% |

|||||

|

4 |

Diversification Level |

0.00% |

1.00% |

|||||

|

5 |

Growth Expectations |

1.00% |

1.00% |

|||||

|

6 |

Competition |

0.00% |

1.00% |

|||||

|

7 |

Age of Company |

0.00% |

0.00% |

|||||

|

2.00% |

5.50% |

|||||||

|

E |

Goodwill |

|||||||

|

1 |

Employees |

0.00% |

0.00% |

|||||

|

2 |

Location |

0.00% |

0.00% |

|||||

|

3 |

Market Territory |

0.00% |

1.00% |

|||||

|

4 |

Products / Services |

0.00% |

1.00% |

|||||

|

5 |

Customer Base |

0.00% |

1.00% |

|||||

|

6 |

Efficiency of Operation |

0.00% |

1.00% |

|||||

|

7 |

Financial Strength |

0.00% |

1.00% |

|||||

|

0.00% |

5.00% |

|||||||

|

Total Capitalization Rate |

18.45% |

26.95% |

||||||

D & E: Specific Company Risk Factors & Goodwill on Value

If you review sections D. and E. more thoroughly, you will see a list of Specific Company Risk Factors and Goodwill. Each of these is in your control but are often overlooked as valuation elements. Driving efficiency, stability, and measurability into these factors has a much larger impact on a business’s worth than most people realize.

Let’s take a closer look at each of the Specific Company Risk Factors and Goodwill and examine how you can lower the cap rate associated with each.

Company Risk Factors

Financial Stability

If you assess your company’s books every quarter as opposed to every month or week, you run the risk of missing something that’s off-track before it’s too late. When you have good data and use tools that allow you to look at your KPIs at-a-glance (data dashboard) you can quickly recognize anything that needs addressing. This provides stability and the ability to address any issues immediately.

Management Depth

If you’re lacking management depth or c-suite execs and you’re “making do” with overworked leaders, this can negatively affect your valuation. If hiring isn’t an option, look for a diverse team of subject matter experts (SMEs) that can jump in and be fractional leaders and assist at a moment’s notice, or engage with your business for as long as needed.

It is also helpful to work with a fractional manager or c-suite executive if you need the creation and implementation of reproducible processes that can become permanent. Management depth is largely about people, process, and data wrapped up into one.

Business Type & Industry

Understanding your business type and industry, and who needs what you offer, is to know wherein lies the complement to what you’re doing. When you understand where your business functions best in your industry and what differentiates you, you can focus on providing customers with added value and up-sell and cross-sell opportunities.

Diversification Level

The diversification level is straightforward. Do you have customer and product diversity? Revenue diversity? Are all your eggs in one basket (one large customer or one expensive product)? How risky are you being by not looking at different choices? When you can introduce diversity into the number or types of customers and/or product or service offerings, you lower your risk.

Growth Expectations

When it comes to your company's growth expectations, it is critical to temper what you want to happen with what’s realistic. Consider how hard growth is really going to be and manage your expectations. Refer to KPIs and trends to forecast, review your exit strategy or succession plan, and be open to new opportunities while being conservative to meet your objectives while reducing risk.

Competition

How many competitors do you have? How much market share does your competition have? What is your market share in comparison? Are you running the risk of unknown technologies or competitors coming up? Are your competitors nimble with less overhead and fewer people getting impressive results? Have you considered “Co-opetition” – sharing the pie? When competitors work together (without price-fixing) healthy competition can build an industry.

Age of Company

The age of your company is outside of your control. However, you can REBRAND! If you’re worried about age and static revenue, by rebranding thoughtfully and strategically you can acquire new customers and a build new revenue stream. You could also white label something. Think outside of the box, and if you’re smart about how you do it, and you can raise the value of an aging company.

Goodwill – Your Company’s Relationships & Loyalty

Employees

Employees will make or break your business (yes, just as much as customers can!). We are seeing this in an exaggerated form right now – pandemic employee woes. Keeping employees happy will inherently help grow your business. Contented team members perform better and tell others – potential employees, customers, and other business relationships (just as unhappy employees will tell everyone). When you take care of your internal people with work-life balance and the things that are important to them, you mitigate risk and raise the value.

Location

Location is a key factor driving value. Your business could’ve started in a great location, but how is it now? What has changed? Consider the following as you assign a percentage of value:

- Is your business brick-n-mortar? Does it need to be?

- Do you own it? Could you do a sale-leaseback?

- Are shipping costs and delivery from where you’re located reducing revenue?

- Could you get better results from a less expensive location?

- Are you in an aging or up-and-coming area?

- Can you downsize or sell an asset?

- Are you a virtual company?

- Is your website doing what it should be (infinite market reach)?

To answer these location questions (and others) and assign risk, it is helpful to perform a data-driven market analysis and a digital operations assessment.

Product & Services

Products and services need to be revisited often. How often do you do an analysis of your offerings? Are they performing as expected? What’s working well, what’s not, what could go, and what new or better offering do you need to stay competitive and lower your risk?

How’s your pricing? Do you need to implement an increase? Do you need to perform an updated go-to-market strategy? Your potential valuation includes year-over-year sales of products and services, so it’s important to get it right and stay on top of it.

Customer-base Risk

Ah, customers. Your bread and butter. Are they happy? Are you sure? Are they getting value? Are you losing some? Gaining some? Why? Are all your eggs in one basket? Do you have your finger on the pulse of your active, somewhat active, and inactive customer base? How many of your customers send referrals (customer advocacy)?

Performing a market segmentation audit will give you an incredible amount of information. And, to truly know if your customers are happy and getting exactly what was promised, you need a working customer relations management tool (CRM). There is no other way to manage and see your customer base in meticulous detail without data-driven KPIs like engagements, losses, referrals, and so much more (an infinite amount of valuation information can come from a CRM).

Operational Efficiency

Operational efficiency can include different operations processes, however, the most common valuation factor here is technology – paper processes vs. digital. Are your machines upgraded and computerized? Are you using business process automation? Is your technology the best technology for your business? Are you in technical debt? If your business is not automated to drive efficiency, reduce repetitive manual tasks and errors, and reduce risk, this will negatively impact your valuation.

Financial Strength

When it comes to financial strength, you need more than just profitability at the end of the year. Do you have good/optimal financial controls? Are payables, receivables, and bookkeeping in order (and digital); do you really know where your money is going? Do you have data-driven policies and procedures in place? Who makes the decision to pay for things? Who has company credit cards? The easier it is to keep track of your money with documentation and data-driven KPIs, the higher your valuation can be.

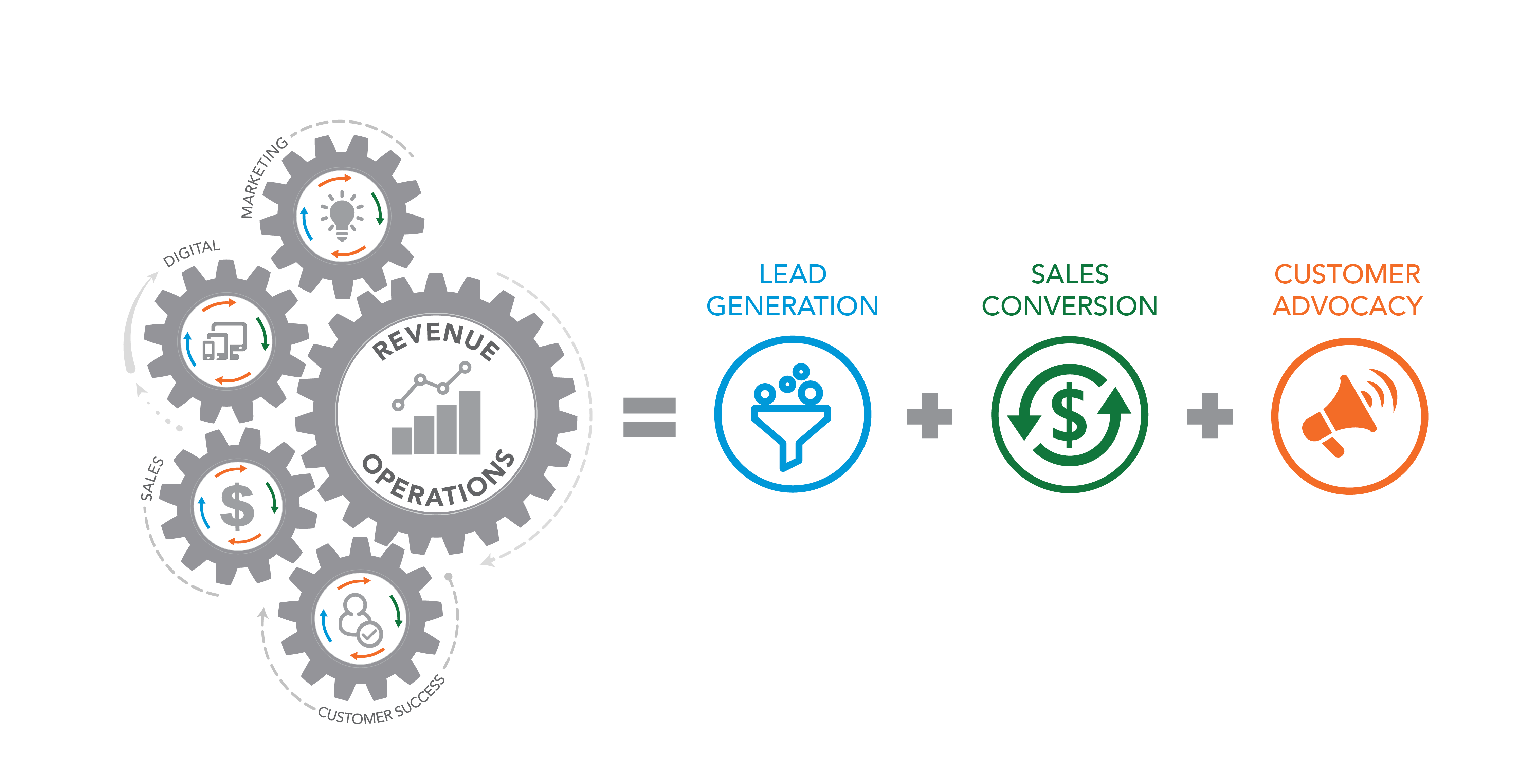

How Revenue Operations Strategies Support the Valuation Process

Inherent in any endeavor is risk. Fortunately, build-up measurements help you see and manage that risk with a cap rate that provides an understanding of what kind of value you’re creating and where your value could be improved.

The question I get asked all the time after performing a risk assessment is “how do we improve the deficient areas on our own and how long does it take?” It is difficult to do this without an objective, outside source to help you get all your people, process, technology, and data-optimized and working together toward customer advocacy, which is the pinnacle of any business objective. This is not a fast process, but one that can be achieved efficiently with the right collaboration.

This is where revenue operations solutions come in.

Revenue operations is the entire process by which a business brings in dollars to fund its existence. Atomic Revenue’s CEO, Tara Kinney, says,

“Regardless of a company’s current data status, all businesses have one thing in common – they need a unified revenue operations strategy to make sure that the right processes collect the right data aggregated into the right KPIs to drive the right decisions so that multiple teams collaboratively achieve the desired business outcomes.”

As mentioned, those outcomes should culminate in customer advocacy. Without advocacy, a business merely survives rather than thrives.

Not sure how to start your company’s valuation process or fix what’s not working? Our team of SMEs is here to help you lower the assigned percentages of each build-up risk factor, lower the cap rate, and in turn, lower your risk while pushing up the value.

Atomic Revenue Can Help You Improve the Things that Impact Your Value

If your B2B organization is one of the following types: a private equity portfolio firm, engineering, manufacturer, companies running on EOS®, B2B healthcare, accounting practice, law firm, commercial real estate, IT MSPS (master service provider), or software and technology solutions provider, Atomic Revenue is here to help you improve the things that impact your company’s value so you can work your exit plan with confidence.

For more information, feel free to reach out to our helpful team today, with no obligation.

Author Bio

![]() Hassan Alan Megahy (pronounced like “fasten”) is an executive and entrepreneur with over 25 years of experience in financial and operational management and startup leadership. He is also an Executive Partner at Atomic Revenue and our valuation and financial modeling expert. Hassan builds financial processes and efficiencies that maximize cash flow without sacrificing the quality and safety of care delivery.

Hassan Alan Megahy (pronounced like “fasten”) is an executive and entrepreneur with over 25 years of experience in financial and operational management and startup leadership. He is also an Executive Partner at Atomic Revenue and our valuation and financial modeling expert. Hassan builds financial processes and efficiencies that maximize cash flow without sacrificing the quality and safety of care delivery.

In addition to owning a successful company in 2005, he worked in the field of Radiation Oncology and served as CFO and COO of an international medical physics software and service company. During his tenure, the company experienced 40-fold growth in three years, culminating in a successful exit and sale in 2018. For that same company, Hassan evaluated and assessed many acquisition targets, which resulted in two strategic acquisitions as a part of the growth strategy.

Over his career, Hassan has conducted dozens of business valuations and provided expertise and guidance to clients seeking to implement profit and operational improvement plans.