Is this a trick question? Every company needs revenue operations! But what is it exactly? It is the entire process by which a business brings in dollars to fund its existence. Although many consider revenue operations to be a function of sales and marketing, it’s this exact oversimplification that limits profitability and often proves to be detrimental for small to midsize businesses.

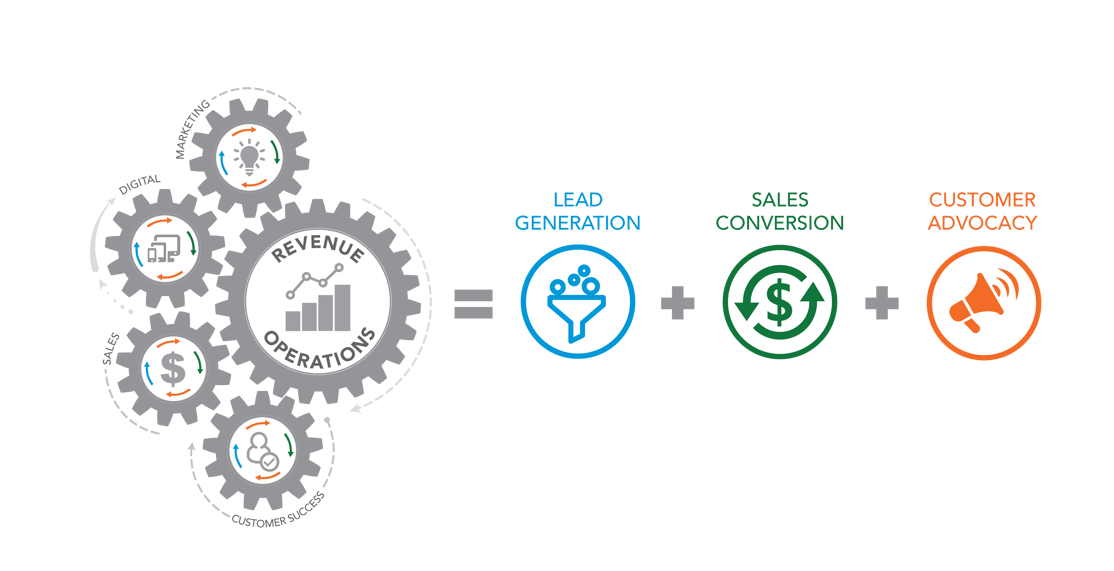

Revenue operations is truly the alignment of all people, process, and data to achieve lead generation, sales conversion, and customer advocacy.

To expound more specifically on which companies need revenue operations, it’s best to start by summarizing revenue operations, before moving into how and why Atomic Revenue’s revenue operations methodology benefits certain types of companies more than others.

Revenue Operations in a Nutshell

Whether you are a one-person consultancy or you manage a 10,000-person international company, revenue operations produce the outcomes which allow your business to:

- pay the bills

- hire people

- build products

- deliver services

- and, ultimately, stay in business!

From lead generation to sales conversion to customer advocacy, and all the supporting parts in-between, your people, process, and data must be aligned to achieve the revenue results that your business needs. There can be no silos; no autonomous departments; no segregated systems – everything works together.

You will hear a lot about the discipline of revenue operations from us at Atomic Revenue.

Most frequently you will hear that “great parts don't mean great results” because individual cogs in the business must be connected to produce the desired outcomes.

Your entire revenue operations machine must function from end-to-end to generate leads, convert sales, and create the customer advocates required for consistent and predictable revenue growth. However, most companies don't have everything working together well enough to turn the revenue operations wheel.

How Do You Optimize Revenue Operations & Achieve Customer Advocacy?

When we look at different types of companies, each has a unique combination of people, a varied set of processes, and diverse systems that track and store data.

Some companies have large volumes of data, and a percentage of those companies develop KPIs that allow data to become information. However, most companies lack data, lack clarity, or lack certainty about how to adjust processes to gather data calculated into meaningful KPIs. While some companies and teams are well-versed at using data to optimize revenue generation, others continue to operate on pure gut instinct.

Regardless of a company’s current data status, all businesses have one thing in common – they need a unified revenue operations strategy to make sure that the right processes collect the right data aggregated into the right KPIs to drive the right decisions so that multiple teams collaboratively achieve the desired business outcomes.

No matter what you sell or who you sell it to, there are over 130 elements of revenue operations that work together to produce lead generation, sales conversion, and customer advocacy outcomes for a business. Atomic Revenue’s experience supporting clients over the past several years confirms that when a company’s people, process, and data are aligned across every function of the business to support the buyer journey, businesses thrive with customer advocacy and optimized revenue operations.

Revenue Growth Culminates at Stage 7 of the Buyer Journey

Customer advocacy is the ultimate objective achieved through the 7-stage buying journey. If your business operates profitably and achieves customer advocacy, then it has the necessary foundation for sustainable growth through continuously optimized revenue operations.

Whether you're buying a leather coat online for yourself or you've been in an 18-month evaluation cycle to buy an ERP solution that's going to take two years to implement, you go through the same 7-stage buyer journey that your customers or clients go through when your company produces revenue.

1. Awareness

You’ve identified what you need and become aware of one or multiple companies that fulfill your need(s).

2. Inquiry

If you're interested in learning more, you engage with the companies that you become aware of to gather information and compare alternatives, thereby becoming a “lead” in their sales process.

3. Conversion

If you are satisfied with what you have learned so far, you agree to be further educated about exchanging money for a solution to your problem. If you agree that the value of the solution is worth the cost of purchase (time, resources, money, etc.) then you buy.

4. Satisfaction

Then the company delivers on the promises made in the Awareness, Inquiry, and Conversion stages of the buyer journey – you get what’s expected for the dollars spent.

5. Retention

If the first purchase was a good experience, then you’ll purchase the same thing again from the same company, retaining trust in the solution that you continue to purchase.

6. Expansion

If the experience was great, beyond trusting the product that you already purchased, you'll expand your trust with the company to buy more solutions to more problems.

7. Customer Advocacy

When the company has done everything you needed, and the whole experience through the first 6 stages of your buyer journey exceeded your expectations, then you become an advocate, promoting and selling the company to others. This is the company’s most valuable lead.

Whether your company struggles to get customers in the door, or you can’t get past stage five, all aspects of revenue production across every area of your company must work together to get customers to stage seven of the buyer journey. Ultimately, customer advocacy produces the lowest cost leads with the highest sales conversion rates and the highest average contract values with the help of your highest lifetime value (LTV) customers. This is the most profitable way to grow efficiently, effectively, and profitably, while caring for the people, process, and data elements of the buyer journey.

Companies that Get the Highest ROI with Atomic Revenue

There are specific types of businesses that realize the highest return on investment (ROI) when working with Atomic Revenue.

These companies tend to fall into high Capital Expenditure (CapEx) business-to-business (B2B) industries with high customer acquisition costs (CAC) and high lifetime value customers.

These companies make substantial investments to build the infrastructure required to fulfill client purchases, and on top of those investments, must fully fund the three stages before and the three stages after the satisfaction stage of the buyer journey. These companies must spend efficiently and wisely to acquire the most customers for the lowest cost per customer as they scale because, until the business reaches capacity, Cost of Goods Sold (COGS) as a percent of revenue will be too high for the business to sustain operations. Every time they reach capacity again, it takes another major capital expenditure to add capacity, which then needs to be achieved as efficiently as possible.

In addition, most B2B companies that work with Atomic Revenue require “labor capacity” to acquire, serve, and support customers. The complex and skilled nature of high CapEx B2B doesn't allow for dynamically firing and rehiring to adjust to the pace of customer acquisition. Revenue operations must support the people required for the business to function. Especially in B2B professional services, but true in all businesses, if you don't have the people available to do the work, then you cannot produce revenue. Right after you close the sale, you can't deliver, therefore your customers don’t or won’t pay, which is the best-case risk scenario for non-delivery on contractual obligations.

Additionally, just because current revenue operations seem to be enough to keep you afloat, that doesn't mean growth nor does it mean adequate profitability. Debt, investors, and cutting corners to make ends meet are methods that organizations commonly use to compensate when revenue operations are not working the way they should. When these methods are used instead of optimizing long-term revenue operations, Atomic Revenue is a superb fit.

Key Industries that Atomic Revenue Serves

Key industries that receive the highest ROI from optimizing their revenue operations with Atomic Revenue include:

- Private Equity Portfolio Companies

- Engineering Services

- Manufacturing

- EOS® Companies

- B2B Healthcare Solutions

- Accounting Practices

- Law Firms

- Commercial Real Estate

- IT MSPs (Master Service Providers)

- Software and Technology Solution Providers

Professional Services

Here there is an element of marketing, an element of sales, and most definitely the service requirement, which is all expensive due to human labor. People are the highest cost within a professional services organization, which is why this is one of the industries that must have high-functioning revenue operations to keep the people on billable and on payroll to deliver the work that has been and will be sold.

Private Equity Portfolio Companies

Just like private equity, Atomic Revenue serves privately held companies to drive EBITDA growth. Because we are big on data, Private Equity Firms and their portfolio companies appreciate KPI clarity, prioritized growth initiatives, and improved profitability from lower CAC, higher LTV, and labor optimization. Because we diagnose, prioritize, and optimize revenue operations, we work with companies before Private Equity, we work with Private Equity in due diligence, and we work with management teams and Private Equity firms on M&A, industry roll-up, new revenue stream, or optimized growth strategies.

Manufacturing

The survival of a manufacturing company requires stable revenue operations to sustain production at or near plant capacity. Manufacturers must invest in plant capacity to produce the goods they’re selling, which is a huge capital expenditure. If there is an investor or bank loan funding operations, the plant needs to be operating at full capacity as quickly as possible. That requires end-to-end revenue production™ with optimized revenue operations. This particular B2B sector tends to optimize plant operations for the minimization of COGS while failing to apply the same principles to optimize revenue operations for the minimization of CAC.

EOS & Scaling Up B2B Companies

Companies striving for operational and cultural excellence are also an excellent fit with Atomic Revenue and the way we serve. Often, these companies are in the process of implementing or already using a business operating system, such as EOS or Scaling Up. Atomic Revenue’s service model for addressing the people, process, and data requirements of revenue operations fit these operating systems like a glove from quarterly cadence to documented processes to leadership facilitation. Companies that are operating on EOS, as we are, thrive in optimizing revenue operations with Atomic Revenue. Revenue Operations Management as a Service (ROMaaS) directly aligns with the Entrepreneurial Operating System (EOS®) and Scaling Up, as well as most other models for operational excellence.

Technology

IT, software, and technology products and services companies are required to spend a lot of money to build and keep pace with the latest technology changes. The question then becomes, once the technology is built, how do you sell it? How are you going to produce revenue from it? We see this a lot − many technologies sell successfully, but have high attrition rates because they fail in the latter stages of the buyer journey. As a result, these companies struggle to grow profitably, remaining flatlined regardless of a successful selling engine.

Are You Ready to Optimize Your B2B Revenue Operations?

Optimized revenue operations directly impact EBITDA, whether it's reducing the cost-of-sale, accelerating customer acquisition, increasing the lifetime value of each customer, or refining revenue operations and business operations to serve the buyer’s journey in the most efficient way possible.

Are you ready to optimize your B2B revenue operations?

- Align and right-size labor (people).

- Document and automate the way business is done (process).

- Manage business to the right KPIs with an integrated dashboard (data).

- Invest in the right resources to achieve the desired revenue operations outcomes (optimize).

Our team thrives on partnering with our clients to help maximize revenue operations and launch measurable growth. Contact Atomic Revenue today for a free revenue operations assessment.

About the Author

About the Author

Tara is the Founder and CEO of Atomic Revenue, where she continues to problem-solve, innovate, and define the formula for and establish the discipline of Revenue Operations that launches client growth with stronger foundations and better ROI. As the company's EOS® Visionary, it is her passion to share what she has learned over the course of her career and help other business owners and leaders increase revenue and grow with consistency. She is also a renowned national speaker.